Introduction To Enclosed Auto Transport Insurance

When it comes to transporting your valuable vehicle, whether it’s a classic car, luxury vehicle, or a cherished family heirloom, ensuring its safety during the journey is of utmost importance. Enclosed auto transport offers a higher level of protection compared to open carrier services by shielding your vehicle from potential hazards such as debris, weather conditions, and even theft. However, despite the added security provided by enclosed transport, accidents or unforeseen events can still occur.

That’s where having proper insurance coverage becomes crucial. Enclosed auto transport insurance is designed specifically to safeguard your vehicle while it is being transported in an enclosed carrier. This type of insurance provides coverage for any potential damage that may occur during transit and offers you peace of mind knowing that you are financially protected. One key aspect to consider when selecting an insurance policy for enclosed auto transport is ensuring that the coverage includes both physical damage and liability protection.

Physical damage coverage will compensate you for any damages caused directly to your vehicle during transportation. This may include scratches, dents, or even total loss in severe cases. Liability protection covers any third-party claims arising from accidents caused by the transportation company during the process. It is essential to thoroughly review and understand the terms and conditions of your insurance policy before entrusting your valuable asset to an enclosed auto transport service provider.

By doing so, you can make informed decisions about the coverage options available and select a policy that best suits your needs.

Understanding The Importance Of Insurance For Enclosed Auto Transport

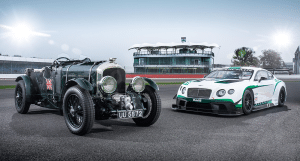

When it comes to transporting your vehicle, especially through enclosed auto transport, understanding the importance of insurance is crucial. While you may have taken great care in selecting a reputable and reliable transport company, accidents and unforeseen events can still occur. Hence, having the right insurance coverage provides peace of mind and financial protection. Enclosed auto transport refers to a method of shipping vehicles where they are securely placed inside an enclosed trailer.

This type of transportation is often chosen by owners of high-end luxury vehicles, vintage cars, or rare automobiles due to its added layer of protection from road debris, weather elements, and potential damages. While most reputable transport companies carry their own insurance policies to cover any potential damages during transit, it is essential for vehicle owners to understand the details and limitations.

Owners should also consider purchasing additional insurance coverage tailored specifically for their vehicle’s needs. Comprehensive insurance coverage for enclosed auto transport ensures that any damages incurred during transit are fully covered. This includes protection against accidents causing physical damage such as dents, scratches, or even total loss scenarios. It is important to review the terms and conditions of the policy carefully before signing up for coverage to ensure it aligns with your specific requirements.

Additionally, it is advisable to choose an insurance policy that covers not only damages caused during transportation but also theft or vandalism incidents while in storage facilities or during loading/unloading processes. Having comprehensive coverage will safeguard your investment against unforeseen events throughout the entire transportation process. In conclusion, understanding the importance of insurance when opting for enclosed auto transport cannot be overstated.

Factors To Consider When Choosing Insurance For Enclosed Auto Transport

When it comes to transporting your valuable vehicle, selecting the right insurance coverage is crucial. Enclosed auto transport offers a higher level of protection compared to open carriers, but it is equally important to have appropriate insurance coverage in case of any unforeseen events. Here are some key factors to consider when choosing insurance for enclosed auto transport:

1. Coverage Limits: Ensure that the insurance policy provides adequate coverage for the total value of your vehicle. Verify if there are any limits or exclusions based on the age, make, model, or condition of your car. 2. Deductible: Determine the amount you would be responsible for paying in case of a claim. Evaluate whether a lower deductible is worth the additional premium cost or if a higher deductible suits your financial situation better.

3. Liability Coverage: Apart from protecting your own vehicle, verify if liability coverage is included in the policy. Liability coverage protects you financially if your vehicle causes damage to other property or injures someone during transportation. 4. Comprehensive Coverage: Consider adding comprehensive coverage to protect against non-collision incidents such as theft, fire, vandalism, or natural disasters that may occur during transit.

5. Reputation and Financial Stability: Research and select an insurance provider with a good reputation and strong financial stability to ensure they can fulfill their obligations in case of a claim. 6. Policy Terms and Conditions: Read and understand all terms and conditions before finalizing the insurance policy. Pay attention to any exclusions or requirements related to inspection reports, storage fees, or additional fees that may affect potential claims.

Types Of Coverage Offered For Enclosed Auto Transport Insurance

When it comes to transporting your valuable vehicle using an enclosed auto transport service, ensuring adequate insurance coverage is crucial to protect against any unforeseen risks or damages. Here are the types of coverage typically offered for enclosed auto transport insurance:

1. Comprehensive Coverage: This type of insurance provides protection for your vehicle against a wide range of perils, including theft, fire, vandalism, natural disasters, and collisions. It offers peace of mind by covering the cost of repairs or replacement in case of damage caused during transit. 2. Liability Coverage: Liability coverage protects you financially if your vehicle causes bodily injury or property damage to others during transportation.

It safeguards you from potential lawsuits and covers legal expenses up to the policy limits. 3. Cargo Insurance: This coverage specifically focuses on protecting the cargo being transported—your vehicle—in case of damage caused by accidents, theft, fire, or other covered perils during transit. Cargo insurance ensures that you are reimbursed for any repair costs or replacement value up to the policy limit.

4. Gap Insurance: Gap insurance covers the difference between your vehicle’s actual cash value (ACV) and the amount you owe on a lease or loan in case it is deemed a total loss during transportation due to an accident or other covered events. 5. Deductible Options: Enclosed auto transport insurance often allows policyholders to choose their deductible amount—usually ranging from $250 to $1,000—which represents the portion they would pay out-of-pocket before their insurance coverage kicks in.

Evaluating The Value Of Your Vehicle And Selecting Appropriate Coverage

When it comes to transporting your enclosed auto, it is important to carefully evaluate the value of your vehicle before selecting an insurance coverage plan. The value of your car plays a significant role in determining the type and level of coverage you should consider. Begin by assessing the current market value of your vehicle. This can be done by researching similar makes, models, and years on reputable websites or consulting with a professional appraiser.

It is crucial to have an accurate understanding of your car’s worth to ensure adequate protection during transportation. Once you have determined the value, consider the potential risks involved in transporting your vehicle. Enclosed auto transport generally offers a higher level of security compared to open transport but accidents or unforeseen events can still occur. Evaluate factors like distance, route conditions, weather conditions, and any potential hazards that may pose a risk to your vehicle during transit.

Based on these assessments, you can then select an appropriate insurance coverage plan. While most transport companies offer basic liability coverage for any damages caused during transit, it may not fully cover the true value of your vehicle. Additional comprehensive or collision coverage options can provide extra protection against theft, damage from accidents or natural disasters. Remember that premium rates for insurance plans vary based on factors such as deductible amounts and declared value limits.

It is advisable to consult with different insurance providers or brokers who specialize in auto transportation coverage to find a policy that suits both your needs and budget.

Exploring Comprehensive Coverage Options For Enclosed Auto Transport

When it comes to transporting your vehicle, especially if it holds sentimental or high-value significance, ensuring its safety during transit is of utmost importance. While standard auto insurance policies may cover damages that occur during accidents or collisions on the road, they often fall short in providing adequate protection during enclosed auto transport. To address this gap, many shipping companies offer comprehensive coverage options tailored specifically for enclosed auto transport.

Comprehensive coverage provides a wide range of protection against various risks that your vehicle may encounter while being transported. This includes damage caused by fire, theft, vandalism, extreme weather conditions like hailstorms or hurricanes, as well as other unforeseen incidents such as falling objects or road debris. With comprehensive coverage in place, you can have peace of mind knowing that your vehicle is safeguarded throughout its journey.

It is important to note that not all enclosed auto transport companies offer the same level of comprehensive coverage. Some may include certain perils as part of their standard package, while others might require additional premiums for specific risks. Therefore, it is crucial to thoroughly review and compare the coverage options provided by different carriers to ensure you choose the one that best aligns with your needs and preferences.

Before finalizing any insurance agreement for enclosed auto transport, carefully read through the terms and conditions outlined in the policy document. Pay attention to details such as deductibles and exclusions to fully understand what scenarios are covered and what falls outside the scope of protection.

Liability Insurance And Its Significance In Enclosed Auto Transport

Liability insurance is an essential component of any enclosed auto transport operation. It provides protection for both the owner of the vehicle being transported and the transport company itself in case of accidents, damages, or any other unforeseen events during the transportation process.

One of the primary reasons liability insurance is significant in enclosed auto transport is that it ensures financial coverage for any potential damage to the vehicles being transported. Accidents can happen at any time, regardless of how careful and experienced the transport company may be. Liability insurance safeguards against these risks by providing compensation for repairs or replacements if a vehicle gets damaged during transit.

Moreover, liability insurance also protects against third-party claims that may arise from accidents involving the transported vehicles. If an accident caused by a transport company results in injuries to other parties or damage to their property, liability insurance covers legal expenses and potential settlement costs.

Furthermore, having liability insurance demonstrates professionalism and reliability on the part of an enclosed auto transport company. Customers feel more secure and confident in choosing a company that has adequate coverage to protect their valuable assets during transit.

In conclusion, liability insurance plays a crucial role in enclosed auto transport by providing financial protection against damages to vehicles being transported and covering legal expenses related to third-party claims. It not only safeguards both parties involved but also enhances trust between customers and transport companies. Therefore, ensuring sufficient liability coverage is vital when considering enclosed auto transport services.

Additional Coverage Options To Enhance Your Peace Of Mind During Transportation

While enclosed auto transport offers significant protection for your vehicle, considering additional coverage options can further enhance your peace of mind during the transportation process. These supplemental coverage options provide an extra layer of financial security and ensure that you are adequately protected against any unforeseen circumstances that may arise.

One popular additional coverage option is Gap insurance. This type of coverage is particularly beneficial if you are financing or leasing your vehicle. Gap insurance helps cover the difference between the actual cash value of your car and the remaining balance on your loan or lease in the event of theft or a total loss. This ensures that you are not left with a significant financial burden should an unfortunate incident occur.

Another valuable option is Rental reimbursement insurance, which covers the cost of renting a replacement vehicle while yours is being transported in case it becomes temporarily unusable due to damage or any other covered reason. This allows you to continue with your daily activities without disruption, even if unexpected delays occur during transit.

Furthermore, consider adding comprehensive insurance to your policy, as it provides coverage for non-collision-related incidents such as theft, vandalism, fire, or acts of nature like hailstorms or floods. By including comprehensive insurance in addition to standard auto transport insurance, you can rest assured knowing that your vehicle is protected against a wide range of potential risks.

While these additional coverage options come at an extra cost, they offer invaluable peace of mind during the enclosed auto transport process. Discussing these options with your insurance provider will help determine which ones best suit your needs and ensure that you have comprehensive protection throughout every stage of transportation.

Researching Reputable Insurers And Comparing Quotes For Enclosed Auto Transport Insurance

Researching reputable insurers and comparing quotes for enclosed auto transport insurance is an essential step when it comes to protecting your valuable vehicle during transportation. While enclosed auto transport offers higher levels of security and protection compared to open carriers, accidents and unforeseen events can still occur. Therefore, securing the right insurance coverage is crucial for peace of mind. To begin your research, it is important to identify reputable insurers who specialize in providing coverage for enclosed auto transport.

Look for companies with a strong track record in the industry, positive customer reviews, and a comprehensive understanding of the unique risks associated with transporting vehicles in an enclosed carrier. Once you have shortlisted potential insurers, it’s time to obtain quotes for comparison. Reach out to each company individually and provide them with detailed information about your vehicle, such as its make, model, year of manufacture, value, and any special features or modifications.

Additionally, inform them about your desired coverage limits and any specific requirements you may have. When comparing quotes, don’t solely focus on finding the cheapest option. Consider the reputation of each insurer as well as the extent of their coverage. Look out for key aspects such as liability coverage (protecting against damage caused to other vehicles or property), comprehensive coverage (protection against theft or damage during transit), and deductible amounts.

Furthermore, pay close attention to any exclusions or limitations outlined in each policy. Some insurers may impose restrictions on certain types of vehicles or exclude coverage for specific damages like acts of nature or wear-and-tear.

Conclusion: Making An Informed Decision On The Right Insurance For Your Enclosed Auto Transport Needs

Choosing the appropriate insurance coverage for your enclosed auto transport is crucial to protect your valuable vehicle during transit. While it may seem overwhelming at first, understanding the key factors involved in this decision can help you make an informed choice and ensure peace of mind throughout the transportation process. First and foremost, consider the value of your vehicle. If you own a luxury or classic car, it is essential to opt for comprehensive insurance coverage that protects against all potential risks, including damage caused by accidents, theft, fire, or natural disasters.

This type of coverage will guarantee that any unforeseen incidents do not result in financial loss. Secondly, carefully review the terms and conditions provided by different insurance providers. Look for policies that offer broad coverage with minimal exclusions. It’s crucial to understand what is covered and what is not under each policy to avoid any surprises in case of a claim.

Additionally, consider whether the insurance policy provides adequate liability coverage. Liability insurance protects you if your car causes damage to other vehicles or property during transportation. Ensuring sufficient liability coverage will prevent any potential legal or financial issues if such situations arise. Lastly, choose an insurer with a reputable track record in providing auto transport insurance. Look for companies with positive customer reviews and a history of settling claims efficiently and fairly.

By taking these factors into account and conducting thorough research on different insurers and their policies, you can make an informed decision regarding the right insurance coverage for your enclosed auto transport needs.